Stay relevant - letter to Partners

Celestial Partners is a boutique investment advisory firm that offers comprehensive one-stop services on global investment and asset allocations primarily for high-net-worth investors and family offices.

For the past 15 years, Celestial has managed a focused portfolio of quality companies, delivering solid returns with low risk. The rise of low-cost passive and actively managed ETFs now offers investors broad access to various asset classes, sectors, and themes. Some new ETFs use large data models to track and rebalance portfolios of quality companies, outperforming the S&P 500 at a much lower cost than traditional funds. With fewer than 10% of active funds beating benchmarks, we have curated portfolios featuring the best opportunities can help clients meet their financial objectives.

This letter in two parts, the first detailing our portfolio of quality companies performance for the first six months of the year, and the latter listing some of our curated portfolios, including alternative investments, all with daily liquidity.

Quality company portfolio

The Celestial Investment Partnership, focussed on quality global companies, results for the first half of 2025 as well as the historic performance over the last 15 years, are shown below:

The first half of the year was marked by significant volatility: shifting tariffs, heightened military tensions in the Middle East, and ongoing conflict in Ukraine have shaped a challenging environment for investors. Despite these global developments, our approach remains constant —we focus on finding the best companies in the world to invest in for the long term. History has shown that high-quality businesses consistently deliver strong performance over time, weathering short-term macro or geopolitical turbulence far better than the broader market. This conviction underpins our investment philosophy for this portfolio and allows us to remain disciplined and focused.

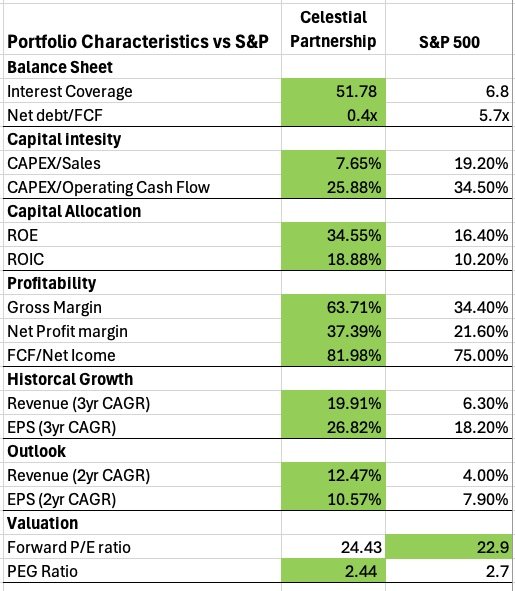

The table below highlights the characteristics of our quality companies portfolio to the averages of the S&P 500 index. In all the key metrics, our portfolio has better fundamentals, other than the forward PE ratio. With better fundamentals, the probability of outperformance over the medium term is high.

The major contributors in the Quality Company portfolioover the last six months were as follows:

NU holdings +32.8% YTD

Tencent +20.9% YTD

Hong Kong stock exchanges +45.9% YTD,

Dino Polska +31.5% over this period.

We initiated our postion in HK stock exchanges in March and only achieved a 23% gain since our investment date.

The major detractors over the first six months of the year were:

Novo Nordisk -31.9% YTD

LVMC -30.0% YTD

LVMC is suffering from the headwinds in luxury, specifically China. The expectation is that with all the structural programmes and stimulus being announced in China, this trend should reverse in months ahead.

Novo Nordisk is a quality business directly impacted by developments in the weight loss category and the US trade war. Most probably one of the most mispriced, quality companies at the moment. The following graph depicts the evolution of NVO earnings per share (EPS) over the last 10 years and the company valuation as represented by its forward price earnings multiple - the forecasted growth in EPS is estimated at 12.4%, this makes NVO the cheapest it has been for the last 10 years! See our brief overview of this business here.

NVO: Earnings per share vs Forward price earnings multiple

Curated Portfolios

We provide a selection of curated portfolios, available for individual access or as components within a broader investment strategy. Based on your specific investment objectives, we will recommend the most suitable portfolio combination.

Dividend Growth Portfolio

Designed for investors seeking income from dividends in well-established companies, this lower-risk strategy offers regular dividend distributions.

Listed Private Equity

Investors can gain exposure to the expanding listed private equity market through two primary approaches:

Ownership of publicly listed private equity investment managers, allowing participation in management fees and carried interest (commonly termed "2 and 20"). The largest private equity managers are publicly traded, their earnings may be unpredictable and variable due to industry dynamics. This is a indirect way to participate in the underlying private equity investments, with liquidity.

Investment in selected serial acquirers with established records of successful growth in shareholder returns.

Recurring Revenue Businesses

This portfolio managed by one of the top performers in large cap US shares, outperformed the S&P500 index constantly, focus on companies generating substantial recurring revenues through subscriptions or frequent repeat transactions. Such businesses typically offer essential products or services, operate with limited competition, and maintain dominant market positions. They consistently grow free cash flow per share without requiring proportionate increases in capital investment, resulting in stable growth and reduced negative surprises.

Thematic Rotation and Directional Strategies

Managed by BlackRock, these actively managed strategies allocate investments to prevailing U.S. market themes, ranging from long-term structural changes to rapidly evolving trends. Utilising big data, it harnesses trending themes seeking long-term capital appreciation through proprietary insights.

Structured Products

Structured products utilise derivatives and advanced financial engineering to create custom payoff profiles linked to underlying indices. These solutions can provide benefits such as capital protection and leveraged upside, depending on structure. Structured products are offered by a leading U.S. provider, with JP Morgan serving as the counterparty on all derivative contracts. The typical investment term is one year, offering daily valuation and liquidity. Current available underlying indices include the S&P 500, the Nasdaq 100, the Russell 2000, and for those that have appetite, Bitcoin.

Multi-Strategy

The portfolio is invested in selected ETF’s providing exposure across asset classes, including equities, fixed income, commodities. The mix is tailored to your risk appetite and investment term.

Further information available here or contact us direct for personal consultation.

Disclaimer: The information provided on this page is for informational purposes only and should not be interpreted as investment advice or as a recommendation to buy or sell any stocks. It merely reflects our views on the companies we have analysed and in certain instances in which we have invested or whose shares we have divested. Please note that the past performance is not indicative of future outcomes and should not be relied upon as such.