Q3 2025 Performance -Curated Portfolios

Dear Valued Investors and Friends

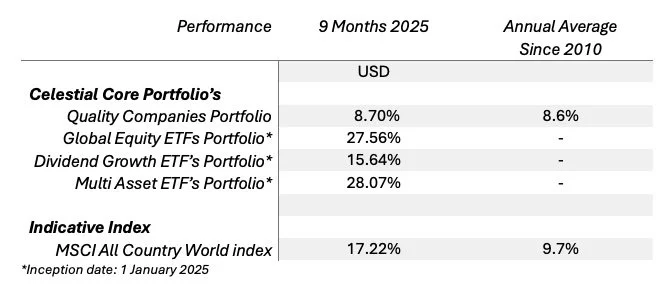

End of September was quarter end, reporting time, how did our core portfolio’s do:

We have had a solid 9 months, especially for the Global Equity ETFs portfolio and the low volatility, Multi Asset ETFs Portfolio, predominantly due to the exposure to non-US companies and the exceptional rise in the value of gold. Lets analyse the composition and performance in greater detail:

Quality Companies portfolio, our concentrated portfolio of great businesses with growing free cash flow and competent management, has underperformed the index due its limited exposure to the AI theme and its strong USD bias. The greatest contributor’s year to date have been Tencent, Autozone, Nu Holdings and PDD Holdings. The major detractors for this period are Novo Nordisk, LVMC and new addition since June, Brown & Brown. (LVMC surged 13% last week on their results announcement). The under performers in this portfolio are all great businesses suffering from short term negative sentiment. The fundamentals of the overall portfolio is significantly better than the average for the S&P 500 as detailed in our June 25 letter, details here.

Something for everyone across the volatility spectrum

Investor’s risk appetite and investment horizons are different. That is why we launched the three newer, core portfolios at the start of this calendar year. The investment philosophy is to provide off-the-shelf portfolios, as decrements on the volatility ladder, suited to different investor needs, with a low total expense ratio (TER). Frictional costs truly matters when investing for the long term. These portfolios includes a global dividend growth ETF portfolio, for those investors seeking regular income.

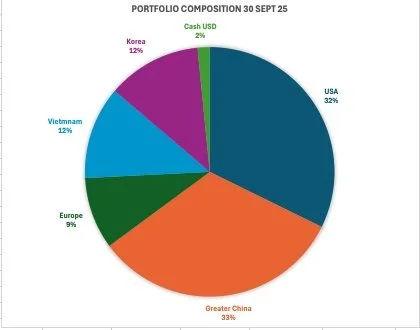

The Global Equity ETFs Portfolio comprises indexed ETFs, focussed on the major stock exchange indices where we believe the underlying markets are undervalued based on historical valuations and anticipated growth rates in GDP. At launch in January of this year, we held a strong view that China, and to a lesser extent, South Korea and Vietnam are cheap and at the cusp of exceptional growth. We placed 30% of the portfolio in three broad Chinese ETFs, that cover the major listed Chinese shares in Shenzhen, Hong Kong and the United States, with an average year to date return of 33%. We placed 10% of the portfolio each in the South Korean and Vietnamese broad market ETFs. Pity about the small allocations: year to date returns have been 56% and 53% respectively. The US allocation was split between S&P 500 equal weight index, the Morningstar wide Moat index and a smaller allocation to the Nasdaq index. The portfolio composition on 30 September was as follows:

The Dividend Growth ETFs portfolio was launched on a lower rung of the volatility ladder to specifically cater with a lower risk profile and a need for regular income. The underlying companies in the portfolio are generally more mature companies paying a growing dividend annually. An ideal portfolio in uncertain markets due to its relatively low valuation and growing annual dividend for investors seeking regular income, or the opportunity to reinvest the dividend flow when buying opportunities arise. On 30 September the gross annual yield on the portfolio amounted to 4.4% in USD and the geographic split of the portfolio is as follows:

The All-Weather-Portfolio or the Celestial Multi Asset ETF Portfolio is based on the Harry Browne portfolio from the 1980’s, also referred to as the “permanent portfolio” or the 25/25/25/25 portfolio with a quarter each allocated to stocks, bonds, gold and cash. The intention is to allocate the assets to uncorrelated asset classes to reduce volatility and withstand major fluctuations in the markets. This is on the lowest rung of our volatility ladder and suited to those investors with low risk tolerance and near-term cash needs.

This portfolio has performed extremely well with a year-to-date return of 28.07%. This is a direct result of the exponential increase in the price of gold. You should not expect this type of return from this portfolio in the future, but more a stable, low volatility performance.

The initial allocation stayed true to the portfolio philosophy with 25% allocated to cash in the form of T-bills, 25% allocated Emerging Markets Government Bonds ETF, yielding 5.9% in USD, 25% allocated to the MSCI all country work index and the 25% gold allocation split 15% in physical gold and 10% in gold miners ETF. No changes have been made to the portfolio since inception, and the current allocation is as follows:

Interesting nuggets from the last week

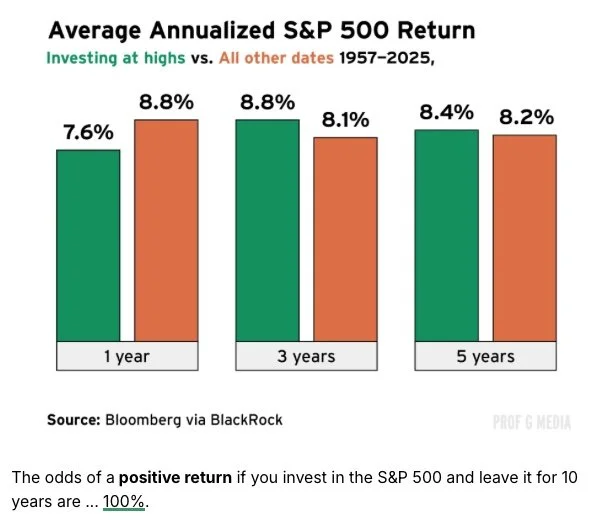

When is the best time to invest?

Scott Galloway publishes a weekly newsletter, Prof G Markets, with some interesting statistics and views. The following graphic fascinated me as it compares the average annual returns of investing in the S&P 500 at its historic highs versus investing in the S&P 500 at all other dates. The long and the short is that it makes sense to be invested at all times, do not try to time the market. It is the same answer to the question when is it a good time to plant a tree? The answer is 20 years ago, and today. The full story can be found here, this is a useful (and free) newsletter to subscribe to.

The case for gold (or not)?

A regular question that I get is whether gold is a sound investment. Even though my views are like those held by David Bahnsen, I believe there is a place for gold in a portfolio of uncorrelated asset classes. In David’s words in response to a reader’s question:

As always, should you have any questions, get in contact, I would love to talk to you.

All the best in these forever interesting markets.

Chris

CELESTIAL PARTNERS

Conviction, Humility, Discipline.

CHRIS MOSTERT

chris@celestialpartners.com | +27 76 078 1735

Risk Disclosure

Investing in financial markets involves inherent risks, including the possible loss of capital. The performance of the Celestial portfolios, as presented in this report, reflects historical results and should not be interpreted as a guarantee of future returns. Market conditions can change rapidly due to a variety of factors, including economic developments, geopolitical events, changes in interest rates, and fluctuations in currency and commodity prices.

Each portfolio is constructed with a specific risk profile in mind, but all investments are subject to market volatility. Portfolios with higher allocations to equities or emerging markets may experience greater fluctuations in value, while those with exposure to fixed income or alternative assets, such as gold, are not immune to periods of underperformance or loss.

Past performance is not indicative of future results. Investors should carefully consider their own investment objectives, risk tolerance, and time horizon before making any investment decisions. We recommend consulting with a qualified financial advisor to ensure that any investment is appropriate for your individual circumstances.

The information provided in this report is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities. Please refer to the portfolio factsheets and legal disclosures for further details.